Financial literacy isn’t just a skill; it’s a necessity in our complex modern economy. Our financial landscape is filled with many challenges—from managing debt and investments to planning for retirement. A personal financial statement is one key financial document that makes navigating these challenges easy.

Personal financial statements, which comprise a balance sheet and cash flow statement, provide a snapshot of your financial health, allowing you to evaluate your current financial condition, track changes over time, and plan for the future. Imagine seeing, at a glance, areas where you can reduce spending, if your net worth is increasing or decreasing, or if you are on track to meet your financial goals.

That’s the kind of clarity these statements provide. They don’t just contain numbers; they provide insights into your financial health, facilitating better decisions and effective long-term planning. For example, a cash flow statement can reveal if you are spending too much on non-essential items, while a balance sheet can show if your debt is becoming unmanageable.

Additionally, analyzing these statements together provides a broad view of your financial situation, helping you identify potential issues before they become significant problems. For instance, if your cash flow statement shows a consistent surplus, but your balance sheet reveals increasing debt, that might be a sign that you are not using your surplus efficiently to pay down debt.

In this guide, we’ll walk you through the two common types of personal financial statements: the personal balance sheet and the personal cash flow statement. We’ll explain each statement, their typical line items, the benefits of creating them, and their limitations.

Finally, we’ll share some pro tips on creating and maintaining each statement, and we’ll examine two case studies that illustrate how each statement can help individuals make better financial choices. At the end of the guide, you will be able to download a free template to get you started on monitoring your finances.

Let’s dive right in.

In a hurry and can’t read this guide in one go? Download the free PDF version to read whenever you have the chance!

A personal balance sheet provides a snapshot of your financial position at a specific period, typically a month or a year. It outlines what you own (assets), what you owe (liabilities), and the difference between the two, known as your net worth. Assets include your house, car, investments, and savings, while liabilities encompass debts such as your mortgage, car loan, and credit card balances.

For instance, say your assets include a $350,000 house, a $30,000 car, $80,000 in investments, $30,000 in savings, and $10,000 in other assets, totaling $500,000. On the other hand, your liabilities include a $150,000 mortgage, $20,000 car loan, $10,000 credit card debt, $15,000 student loan, and $5,000 in other debts totaling $200,000. In this scenario, your net worth would be $500,000 (Total Assets) – $200,000 (Total Liabilities) = $300,000.

Understanding, creating, and maintaining a personal balance sheet helps you make informed decisions about investments, loans, and other financial matters. For example, by knowing your net worth, you can determine how much debt you can afford for a new home or car, how much you can reasonably invest, or whether you need to focus on paying down existing debt.

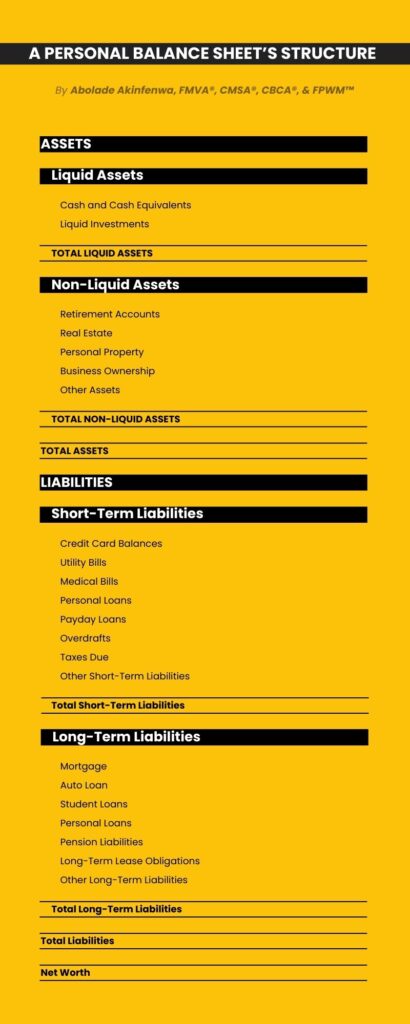

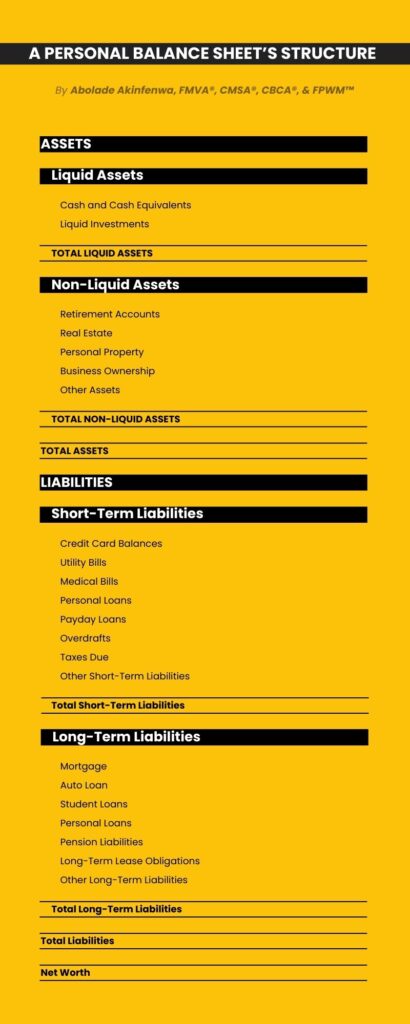

A personal balance sheet consists of two major categories: assets and liabilities. You can further divide these categories into subcategories that outline what you own and owe. Let’s briefly examine the typical structure of a personal balance sheet.

“Assets” is the first section on a personal balance sheet, and it covers everything you own that has a monetary value. These include tangible items like your home, car, and personal belongings, as well as intangible items like investments and savings accounts. Essentially, anything you could sell or cash in for money is considered an asset.

Assets are typically categorized into two groups: liquid and non-liquid assets. Let’s briefly examine the types of assets that fall under each group.

“Liquid Assets” is the first category under the “Assets” section. It includes all assets that can be quickly and easily converted into cash without losing much value. Such assets include the following:

“Non-Liquid Assets” is the second category under the “Assets” section. This subcategory covers all assets that cannot be easily converted into cash or would lose value in the process. Such assets include the following:

“Liabilities” is the second section on your personal balance sheet, and it represents all debts and financial obligations. These can include various forms of debt, such as mortgages, car loans, credit card balances, and personal loans. Essentially, anything you need to pay back to others, whether to a bank, a credit card company, or a friend, is considered a liability.

Just as with assets, liabilities are also usually categorized into two groups: short-term and long-term liabilities. Let’s briefly examine the types of liabilities that fall under each group.

“Short-Term Liabilities” is the first category under the “Liabilities” section. It includes all debts that are due within a year. Such liabilities include the following:

“Long-Term Liabilities” is the second category under the “Liabilities” section. It includes all debts that are due in more than a year. Such liabilities include the following:

“Net Worth” is the final figure on a personal balance sheet. This figure is a clear indicator of your financial health, and you can calculate it using the following formula:

For instance, let’s assume you own a house valued at $350,000, have a car worth $20,000, a retirement account with $50,000, and a savings account with $10,000, putting your total assets at $430,000. Let’s further assume you have a mortgage balance of $200,000 and a car loan of $15,000, putting your total liabilities at $215,000. In this scenario, your net worth would be:

This positive net worth of $215,000 implies that you own more than you owe, which is the ideal financial position to be in. Suppose your liabilities had exceeded your assets in the preceding scenario. In that case, you’d have a negative net worth, meaning you owe more than you own.

Your net worth is a crucial measure of your financial stability. A high positive net worth implies that you are in a strong financial position and have effectively managed your income, savings, investments, and debts. A negative net worth, on the other hand, signals the need to reevaluate your financial habits to reduce debts and increase assets to avoid financial insolvency.

Understanding your financial situation is crucial for making informed decisions about your future. A personal balance sheet is a valuable tool for gaining this understanding. Here are some key benefits of creating and maintaining this financial statement:

Regularly creating and reviewing your balance sheet increases your awareness of your financial situation. This heightened awareness can lead to better financial decisions, such as avoiding unnecessary debt and expenses, making better investment choices, and being more disciplined with savings.

For instance, if you notice that a large portion of your income is spent on dining out and entertainment, this awareness could lead you to make more disciplined spending choices, such as cooking at home or choosing free entertainment options.

Moreover, understanding your financial situation can also lead to psychological benefits. For example, knowing that you have a manageable level of debt and a solid savings plan reduces financial anxiety and increases confidence in your ability to achieve your financial goals. Additionally, this awareness fosters a sense of control over your finances, encourages a more disciplined approach to spending and saving, and promotes a more positive and proactive outlook towards your financial future.

A balance sheet provides a quick, overall view of your financial health by showing your assets and liabilities at a glance, making it easier to identify financial strengths and weaknesses. For example, if your balance sheet reveals that your credit card debt is more than 50% of your total assets, it’s a clear sign that you need to focus on debt reduction. Ignoring this signal could lead to escalating debt, higher interest payments, and a lower credit score.

Conversely, if your balance sheet shows that your assets are three times greater than your liabilities, that implies positive financial strength. You could leverage this strength by investing in higher-yield assets or taking on manageable debt to invest in opportunities with a high return on investment.

However, it is crucial to approach this cautiously and consider the potential risks involved. Do thorough research or consult a financial advisor before making significant financial decisions.

Creating and updating your personal balance sheet regularly helps you monitor your wealth over time. This ongoing tracking lets you see if you’re progressing toward your financial goals and pinpoint areas needing improvement.

For example, if you observe that the value of your stock portfolio has decreased significantly over the past year, this might indicate that your investment strategy needs to be reevaluated. Failing to take action could result in further losses, considerably reducing your overall wealth.

It’s important to factor in economic variables like inflation when assessing your financial growth. A nominal increase in wealth doesn’t always equate to an actual increase in financial well-being. For instance, a 3% increase in your wealth over the past year may seem positive, but if the inflation rate is 5%, your real wealth has actually decreased by 2%. It’s great to see your wealth grow year after year, but it’s essential to ask yourself: does the growth rate outpace or at least keep up with inflation?

A personal balance sheet is an effective tool for planning financial goals. By knowing your net worth, you can devise better strategies for saving, investing, or debt repayment, helping you make informed decisions to achieve your financial goals. Let’s say you notice that your net worth is decreasing; it might be time to cut expenses, pay down debt, or reconsider large purchases or investments.

For example, if your net worth has decreased by 10% over the past year, you might decide to sell non-essential assets, reduce discretionary spending, or refinance your debt to lower interest rates. Doing a mix of the preceding will help you increase your net worth.

Additionally, a personal balance sheet can help you create a clear and detailed financial plan. For example, by knowing your net worth, you can set realistic savings and investment goals for the next year.

Remember, it is necessary to regularly revisit and adjust your financial plan and goals as your financial situation changes. Factors that may necessitate a change in your plan include a change in income, unexpected expenses, or changes in your financial goals. For example, if you receive a promotion and a salary increase, you may want to adjust your savings and investment goals accordingly. Similarly, if you incur unexpected medical expenses, you may need to adjust your budget and debt repayment plan.

Creating and maintaining a personal balance sheet makes it easier to calculate and track important personal financial ratios like the debt-to-asset ratio and capitalization ratio. These ratios are crucial for assessing your financial health and stability. For example, the debt-to-asset ratio helps you understand how much of your assets are financed by debt. In contrast, the capitalization ratio helps you understand your financial structure by showing the proportion of debt owed relative to equity owned.

While a personal balance sheet is an indispensable tool for understanding your financial health, planning your financial future, and making informed financial decisions, it’s also important to recognize its limitations. Knowing them helps you better interpret the information your balance sheet provides and understand what additional steps you may need to take to neutralize each limitation. Here are some key limitations of a personal balance sheet:

A balance sheet provides a snapshot of your financial situation at a specific point in time but doesn’t show cash flow. A cash flow statement provides a dynamic view of how money is earned and spent over a specific period. This can highlight issues not immediately apparent from the balance sheet, such as a negative cash flow despite a positive net worth. For example, someone might have a high net worth and still have cash flow problems because most of their assets are illiquid (e.g., real estate, long-term investments, etc.). Creating and maintaining a balance sheet and a cash flow statement is a great way to overcome this limitation.

The values of assets and liabilities can fluctuate over time, making the balance sheet a snapshot accurate only at the moment it’s prepared. And this variability can significantly impact your financial planning and decision-making. For example, if you intend to sell some of your stocks, the value of those stocks when preparing the balance sheet may differ from the value at the time of the sale. This discrepancy could result in overestimating or underestimating the sale proceeds in your budget, each having distinct repercussions.

Consider a scenario where you plan to use the sale proceeds to repay debt. If the actual proceeds are lower than anticipated, you may find yourself unable to cover the debt fully, leading to additional interest charges or penalties. For this reason, it’s crucial to update your balance sheet frequently and exercise caution when making financial decisions based on it.

Some assets, like jewelry, art, or antiques, can be difficult to value accurately, making it challenging to create an accurate personal balance sheet. For instance, valuing a piece of art at $12,000 when it’s actually worth $5,000 will inflate your net worth and potentially mislead your financial planning. It’s advisable to consult a professional appraiser for items of significant value to mitigate this limitation.

The effectiveness of a balance sheet depends on the accuracy of the data inputted. Even minor errors in asset or liability values can lead to incorrect conclusions about your financial health. For example, an underestimation of debt by $1000 may seem inconsequential, but when interest is taken into account, the actual value of that debt could be significantly higher over time. This could lead to understating the time and money required to repay that debt.

Creating a personal balance sheet is crucial for anyone interested in managing their finances responsibly. However, the real benefit of a personal balance sheet lies not just in its creation but in regularly updating and using it wisely. Here are some pro tips to help you make the most of your personal balance sheet:

Gather all your financial documents, such as bank statements, mortgage statements, and credit card bills, before creating your balance sheet. Doing so will help ensure you don’t miss any assets or liabilities.

Break down your assets and liabilities into categories such as liquid assets (cash, savings), non-liquid assets (real estate, investments), short-term liabilities (credit card debt, other debts due within a year), and long-term liabilities (mortgage, student loans).

Include expected future liabilities, such as a child’s college education, a planned home renovation, or future taxes, in your personal balance sheet. Doing so will help make your financial planning more accurate and effective.

For example, let’s say you’re planning for your child’s college education. You can estimate this future liability by researching the current tuition fees of the college your child might attend and its historical growth rate.

Suppose the current tuition fee is $30,000 per year, and historically, the tuition fee has increased by 5% annually. You can estimate that in 10 years, the tuition fee would be approximately $48,890 per year ($30,000 × (1 + 0.05)^10). This estimation will help you plan and save accordingly.

Be conservative when estimating the value of your assets. This means using the lower end of an estimated value range and being cautious when including assets whose value is highly uncertain. Overestimating the value of your assets provides a false sense of financial security and leaves you unprepared for unexpected financial downturns.

Being conservative matters a lot in creating an accurate personal statement, but so does being thorough. Ensure you include all your assets and liabilities, even if they seem insignificant. Small amounts can add up over time and may affect your financial health more than you realize. Assets and liabilities commonly overlooked include:

Update your balance sheet at least every quarter or when there is a significant change in your assets or liabilities, such as receiving an inheritance, buying a house, and paying off or incurring a debt. Recording changes in your assets and liabilities is the best way to spot trends you would have otherwise missed. Moreover, doing so helps make your balance sheet more accurate.

While you should update your personal balance sheet at least four times a year, it’s a good idea to monitor it regularly. Set a schedule for reviewing your personal balance sheet, such as monthly or quarterly. Regularly reviewing past balance sheets can help you identify trends, understand how your financial situation has changed, and make more informed decisions about the future.

To better understand your financial health, use your personal balance sheet together with a personal cash flow statement. While the balance sheet provides a snapshot of your financial health at a specific point in time, the cash flow statement shows how you earned your money or spent it over a specific period. Using both financial statements will help you identify trends, gain more insights, and make more informed financial decisions.

There are various tools and templates available online, such as Microsoft Excel templates, personal finance apps, or online budgeting tools that offer personal balance sheet templates. You can start with a basic template from Microsoft Excel and customize it to include categories specific to your financial situation, like adding a section for digital assets or future liabilities.

After creating your balance sheet, reflect on your financial situation. Are you meeting your financial goals? Do you need to adjust your spending or saving habits? Use your balance sheet as a tool for making informed financial decisions.

If you are dealing with a complex financial situation, such as managing investments across multiple platforms, dealing with significant debt, or planning for retirement, it might be beneficial to seek advice from a certified financial planner or wealth manager. A financial planner can help you create a comprehensive financial plan, while a wealth manager can help you manage your investments and optimize for tax efficiency.

A personal cash flow statement tracks how much cash you’re earning and where it’s being spent over a specific period, typically a month or a year. This statement provides valuable insights into how you are managing your cash resources, enabling you to understand your spending patterns and make better financial decisions.

A personal cash flow statement records cash inflows and outflows during a specific period. Think of it as a story of your personal finances from a cash perspective, showing you where your money came from (inflows), where it went (outflows), and the net difference between the two. If your inflows exceed your outflows, then you’ll have a positive cash flow. Conversely, if your outflows exceed your inflows, then you’ll have a negative cash flow.

For example, let’s say your monthly cash inflows (salary, freelance work, etc.) are $5,000, and cash outflows (rent, utilities, groceries, etc.) amount to $3,200. In this scenario, your personal cash flow statement for that month would show a surplus of $1800, money you can put towards savings, investment, or other financial goals.

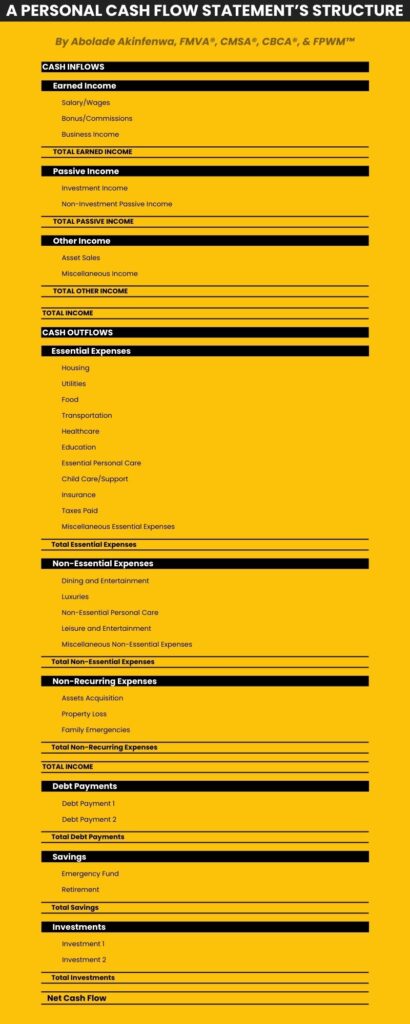

A personal cash flow statement typically consists of two main sections: cash inflows and cash outflows, which can be further divided into various categories and subcategories.

When creating a personal cash flow statement, it is essential to break down your cash inflows and outflows into different line items that track your income sources and expenditures. This detailed breakdown provides a clearer view of your financial situation, helping you identify potential areas for savings or producing additional income.

Let’s briefly examine the typical structure of a personal cash flow statement.

“Cash inflows” is the first section on a personal cash flow statement; it covers all the money that comes into your possession during a specific period, usually monthly or yearly. These inflows can include your salary, bonuses, dividends from investments, rental income, money received from selling assets, gifts, or any other sources of income. Essentially, any money you receive or earn is a cash inflow.

Cash Inflows are typically grouped into three categories: earned income, passive income, and other income. Let’s briefly examine the types of cash inflows that fall under each category.

“Earned Income” is the first category under the “Cash Inflows” category. It covers any money you earn by providing a service, working a job, or running a business.

Common types of income under this category include the following:

“Passive Income” is the second category under the “Cash Inflows” section, and it highlights any cash you earn without active, ongoing effort after the initial groundwork or setup. This category typically contains the following subcategories:

“Other Income” is the third category under the “Cash Inflows” section, and it includes any other money you receive that doesn’t fall under the categories of earned or passive income. Typical subcategories under this category include the following:

“Cash outflows” is the second section on a personal cash flow statement, and it represents all the money you spend during a specified period, typically monthly or yearly. These outflows include expenses such as rent or mortgage payments, utility bills, groceries, transportation costs, loan repayments, and entertainment.

Essentially, any money you spend is a cash outflow, and unlike cash inflows, which increase your available funds, cash outflows reduce them. Let’s briefly examine the types of cash outflows that fall under this section.

“Essential Expenses” is the first category under the “Cash Outflows” section. It tracks all necessary costs you incur to maintain your basic standard of living. In other words, this category covers every cash you spend on needs rather than wants. Another way to think about essential expenses is that they are cash you need to spend to survive and function in society. Common types of expenses under this category include the following:

“Non-Essential Expenses” is the second category under the “Cash Outflows” section. All expenses that aren’t necessary for your survival or basic comfort but contribute to your lifestyle and happiness fall under this category. These expenses are typically optional and can be reduced or eliminated if necessary. Common types of non-essential expenses under this category include the following:

“Non-Recurring Expenses” is the third category under the “Cash Outflows” section. It accounts for essential or non-essential expenses that don’t occur regularly or predictably and don’t fit under preceding categories and subcategories. For example, acquisition of assets, legal fees, or any unexpected expenses like family emergencies. Common types of non-recurring expenses under this category include the following:

“Debt Payments” is the fourth category under the “Cash Outflows” section. Any money used to repay the principal and interest on your debts is recorded under this category.

“Savings” is the fifth category under the “Cash Outflows” section. It tracks whatever income is set aside for future use, such as an emergency fund, retirement, or specific financial goals. Common line items under this category include goal-specific savings, emergency funds, retirement accounts, etc.

“Investments” is the sixth category under the “Cash Outflows” section. It covers any money used to purchase assets with the expectation that they will generate a return in the future. Line items commonly recorded under this category include stocks, bonds, mutual funds, real estate, start-up investments, etc.

Calculating your net cash flow is the final step in creating your personal cash flow statement. Net cash flow is the figure you get after subtracting your total cash outflows from your total cash inflows. It’s a vital indicator of your financial liquidity. You can calculate this figure using the following formula:

To illustrate how to calculate net cash flow, let’s consider the following example. Assume your total cash inflows, which include your salary of $4,000, investment income of $500, and other income sources of $500, come to $5,000 per month. And your total cash outflows, encompassing costs such as housing ($1,500), food ($500), transportation ($400), personal expenses ($400), and debt repayments ($900), sum up to $3,700 per month. In this case, your net cash flow would be:

Your net cash flow is $1,300 in this scenario, indicating a positive cash flow. This means you earn more than you spend, leaving you with excess cash that can be used for savings, investments, or reducing debt.

Interpreting your net cash flow involves understanding what the number means for your financial health. A positive net cash flow indicates a healthy financial situation where you live within your means and have leftover income to allocate towards savings, investments, or debt repayments. This is generally an ideal financial position to be in.

Conversely, if your net cash flow is negative, you spend more than you earn. A negative net cash flow could be due to one-time large expenses or indicate a pattern of overspending. If it’s the former, this may not pose a long-term issue, but if it’s the latter, you may need to reassess your budget and spending habits. Creating a detailed budget, tracking your expenses, and identifying areas where you can cut back or increase your income can help turn a negative net cash flow into a positive one.

To summarize, your net cash flow reveals whether you’re living within your means or overspending. It can serve as a wake-up call to adjust your spending habits or as a green light that you’re on track with your financial plans.

Creating a personal cash flow statement is more than just a financial exercise; it can help you develop a roadmap to your financial freedom. Whether you’re struggling with budgeting, debt, or planning for the future, a personal cash flow statement can provide invaluable insights. Here are some of the key benefits you unlock when you create a personal cash flow statement:

Regularly updating and reviewing your personal cash flow statement not only helps you keep tabs on your financial situation but also increases your awareness of your spending habits. For example, regularly reviewing your personal cash flow statement might help you notice that you’re consistently spending $100 monthly on takeout. Noting this pattern is the first step toward deciding whether this is an area where you can and should cut back.

Interestingly, as you regularly review your personal cash statement, you will become more conscious of your spending decisions in real time, not just when you review your statement.

A personal cash flow statement can help you create a more detailed and practical budget by identifying exactly where your money is going. And with a comprehensive cash flow statement, you can easily spot areas where you may need to cut back on your expenses or allocate more funds.

For instance, let’s say you notice that your grocery bill has increased significantly over the last six months. You can delve deeper to understand why and adjust your budget or behavior accordingly. You may decide to allocate more funds to your grocery budget for the following months or find ways to reduce grocery expenses. This real-time feedback loop is invaluable for effective budget management.

By highlighting your disposable income or the money left over after all cash outflows have been accounted for, a personal cash flow statement can help you set realistic financial goals, both short-term and long-term. This way, you’re not just aiming mindlessly but setting achievable targets.

For instance, if your cash flow statement reveals that you have $300 left each month after essential expenses, setting a goal to save $500 a month would be unrealistic and could leave you frustrated. On the other hand, a realistic goal based on your actual disposable income, such as saving 20% ($60) monthly, can improve your financial self-esteem and encourage you to maintain or improve your financial habits.

Evidently, setting achievable goals not only improves your financial self-esteem but also leads to a sense of accomplishment that motivates you to set and achieve more financial goals.

Effective debt management is critical to eliminating liabilities within the shortest possible time to avoid unnecessary interest payments. A well-structured cash flow statement can reveal non-essential expenses you could cut back on or eliminate to free up funds to fast-track your debt repayment.

Consider this scenario: After creating a monthly cash flow statement, you notice spending $200 on gourmet coffee and $150 on streaming services. Making coffee at home and canceling a few subscriptions could free up $350 monthly or $4,200 annually!

When redirected to your credit card debt, this surplus can significantly reduce your outstanding balance and the interest you’d otherwise accrue, fast-tracking your path to being debt-free. Similar savings can be spotted in areas like dining out, unused gym memberships, or impulse online purchases.

Remember, staying disciplined with your repayment strategy is vital to managing and eliminating debt. Timely repayments free you from debt faster and improve your credit score, opening doors for better financial opportunities in the future.

The insights a personal cash flow statement provides are not limited to tracking income and expenses. By using your cash flow data, you can easily calculate key personal financial ratios. An example of these ratios is the debt-to-income ratio, calculated by dividing total monthly debt payments by total income.

Personal financial ratios are more than just numbers. Despite popular misconceptions, they are performance indicators that can help anyone gauge their financial health and make informed decisions. For example, lenders consider a debt-to-income ratio higher than 0.36 as a red flag. Your ratio exceeding this threshold may result in higher interest rates on loans or make it challenging to secure credit. In such a situation, it’s prudent, therefore, to reduce existing debt before attempting to take on additional debt.

By creating and regularly updating your cash flow statement, you can actively monitor these ratios, spot trends, and make adjustments to reach financial goals more effectively.

While a personal cash flow statement is invaluable for understanding your finances, it has limitations, which, when recognized, can lead to a more accurate interpretation of your data. Here are a few limitations to remember when analyzing a personal cash flow statement.

A cash flow statement primarily captures present transactions and doesn’t account for upcoming financial obligations like loan repayments or planned investments. For instance, if you’ve recently agreed to a car lease or plan to enroll in a long-term course next year, these commitments won’t appear in your current statement, potentially underestimating future expenses. You can neutralize this limitation by creating a forward-looking budget alongside your cash flow statement.

A cash flow statement won’t reflect the value of assets such as your home, car, investments, or savings, thus not fully representing your wealth. A balance sheet, on the other hand, provides a snapshot of your assets, liabilities, and net worth, offering a comprehensive view of your overall wealth. As such, it’s important to use your cash flow statement together with a balance sheet to get a complete picture of your current financial health.

It’s easy to overlook some expenses, especially smaller or infrequent ones, which can make your cash flow statement inaccurate. One way to mitigate this limitation is by meticulously tracking all cash outflows, no matter how small. You can do this by using an expense tracking app, keeping all receipts, or reviewing bank statements.

A personal cash flow statement only provides a snapshot of your cash inflows and outflows for a specific period, typically a month or a year. It does not reflect changes in your financial situation over time. For instance, if you faced a significant medical expense in January and then maintained a strict budget for the next few months, a cash flow statement for April might not reflect the financial strain you experienced at the start of the year. To track your financial progress, you need to regularly update and review your cash flow statement and compare it with previous periods.

Understanding your cash flow is essential for managing your finances effectively. A personal cash flow statement enables you to identify patterns, plan for the future, and make informed financial decisions. However, to get the most out of your personal cash flow statement, you need to be diligent in its creation and usage. Here are some pro tips for creating and using a personal cash flow statement effectively:

Record all inflows and outflows, no matter how small, to make your cash flow as accurate as possible. Even minor discrepancies can lead to an inaccurate picture of your financial health. For example, small expenses like daily coffee or occasional parking fees are often overlooked. However, a $5 daily coffee adds up to $150 monthly and $1,825 yearly. Assuming your yearly expenses amount to $36,000, you underreport your expenses by ~5% every year.

Make sure the time frame for your cash flow statement matches the time frame for your budget and financial goals. A monthly cash flow statement is appropriate for most people because many expenses and income sources occur on a monthly basis. However, if you have significant irregular expenses or variable income, you may need to review and update your cash flow statement more frequently, such as weekly or bi-weekly.

When noting your expenses, avoid grouping them into overly broad categories to understand your spending patterns better. For example, instead of vaguely listing $150 for “utilities,” you could break it down: $50 for “electricity,” $40 for “water,” $30 for “internet,” and $30 for “gas.” Such granularity can reveal surprising spending habits, like unusually high water cost that prompts leak checks or water conservation efforts.

However, it’s also crucial not to overwhelm your cash flow statement with excessive detail. Excessive details can clutter your statement, making it harder to identify overall trends or patterns quickly. For example, instead of listing “Netflix,” “Hulu,” and “Disney+” separately, group them under “Streaming Services”. The goal is to find a categorization balance that ensures your cash flow statement remains streamlined yet insightful, setting the stage for well-informed financial decisions.

Distinguishing between essential and non-essential expenses helps you identify areas to cut costs. Essential expenses are the basic costs incurred to maintain a safe and healthy living standard; they cover the fundamental needs required to live and work in modern society. Such expenses include groceries, housing, healthcare, utilities, and transportation. On the other hand, non-essential expenses are costs that enhance your life but aren’t vital for your basic survival. Dining out, vacations, luxury shopping, streaming services, etc., are non-essential expenses.

Note that essential expenses can differ based on individual circumstances and lifestyles. For example, if you work from home, high-speed internet becomes a necessity, whereas someone without remote work might view it as a luxury. It’s essential to recognize that what’s necessary for one person might be a luxury for another. Tailor your cash flow statement to reflect your unique needs and priorities.

Always ensure that you maintain a financial buffer for emergencies and unexpected expenses. Aim to set aside at least 3-6 months’ worth of living expenses in an easily accessible account. This duration is often optimal as it provides adequate coverage for scenarios like unexpected job losses, sudden medical bills, or major home repairs.

Keep your emergency fund in a high-yield savings account, where your money remains readily accessible and earns interest. You might also consider diversifying your emergency fund by putting a portion in money market accounts or short-term certificates of deposit for potentially higher returns.

Your cash flow statement is a dynamic document that should be reviewed and updated regularly. Regular updates help you stay on top of your finances and make necessary adjustments promptly. Update your cash flow statement as regularly as possible. Monthly updates are standard, but you may want to update more infrequently if your inflows and outflows rarely change.

Make it a habit to regularly review your cash flow statement to pinpoint areas where you can trim expenses. If, for instance, you notice a significant portion of your money goes into dining out, consider cooking at home more often to reduce costs. Similarly, evaluate monthly subscriptions to see if there are any you no longer utilize, or consider cheaper alternatives to recurring expenses, ensuring every dollar is spent wisely.

Review your cash flow statement regularly to identify opportunities for increasing your income. This could include asking for a raise, starting a side hustle, or investing in income-generating assets. For instance, if you have a skill like graphic design, you could begin freelancing and taking on small projects in your free time. Alternatively, investing in income-generating assets like dividend stocks or real estate can also increase your income.

Setting achievable goals for savings, investments, and debt repayment is crucial. For example, if your monthly income is $3,000, setting a goal to save $1,500 monthly may be unrealistic after accounting for all other expenses. Always consider all your essential expenses before setting aside a savings goal.

Using a financial tracking app or software can help you keep track of expenses and minimize omissions. Many apps like Mint, YNAB, Spendee, and PocketGuard offer features that can help you track your expenses, set budgets, and monitor your investments. Look for an app that allows you to categorize your expenses, set alerts for overspending, and provide a visual representation of your financial health.

Your personal cash flow statement is one part of your financial profile. Pairing it with a balance sheet provides more accurate insights into your financial status, allowing you to identify areas of vulnerability, such as looming debts, and opportunities, like potential investments.

By tracking your monthly net cash flow statement from the cash flow statement and your net worth from the balance sheet, you can strategically plan for future investments, debt repayments, and savings. For instance, if your cash flow statement shows a consistent surplus each month, but your balance sheet reveals high-interest debt, it might be wise to allocate some surplus towards that debt reduction.

Feel free to seek assistance from a financial advisor or planner if creating and managing your cash flow statement seems overwhelming. While a financial advisor can be helpful for anyone, it is especially beneficial for those with more complex financial situations, such as multiple income streams, significant debts, or an extensive investment portfolio. For example, if you have $20,000 in credit card debt, a financial planner can help you develop a plan to pay it off within a realistic timeframe.